OpenSea Saw a 646x Increase in Trading Volume in 2021

Содержание статьи:

Shutterstock cover by sdx15

Key Takeaways

NFT marketplace OpenSea has registered a colossal $14 billion in trading volume throughout 2021, far outpacing its 2020 performance of $21.7 million.

OpenSea’s Breakout Year

2021 will go down as the year of NFTs—and OpenSea.

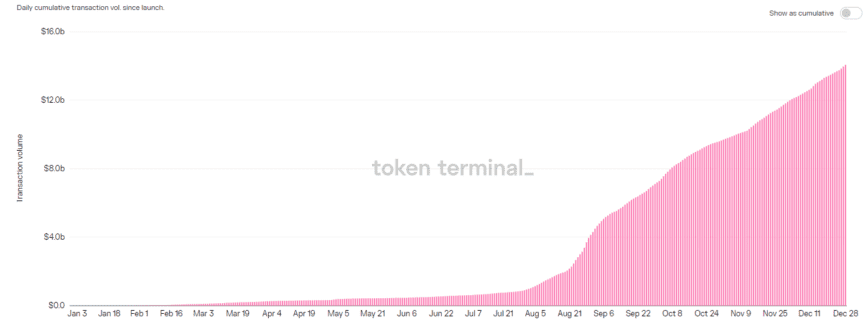

OpenSea will finish the year with over $14 billion in trading volume conducted. The leading NFT marketplace saw a volume of $21.7 million in 2020, which means trading increased by a factor of 646 this year, according to data from Token Terminal.

OpenSea daily cumulative transaction vol. Source: Token Terminal

OpenSea daily cumulative transaction vol. Source: Token TerminalAs the premier destination for NFT trading, OpenSea has left its competitors in the dust, far outpacing trading volumes on rival marketplaces. The next largest platform, Rarible, handled $260 million worth of transactions in 2021, according to data from DappRadar.

With such high transaction volume, OpenSea has also booked record profits. The marketplace takes a 2.5% cut from every NFT bought and sold. Protocol revenue, a total of the fees paid to OpenSea, currently stands at a cumulative $351.6 million for the year.

The collection that earned OpenSea the most in fees this year was Bored Ape Yacht Club. Launched in April, Bored Apes started a new trend of NFT animal avatar projects, riffing on the success of the original generative avatars, CryptoPunks. Since the project’s launch, Bored Apes have registered a trading volume of over 280,000 ETH, around $1.06 billion, or 6.3% of OpenSea’s entire volume.

Despite their surge in popularity, Bored Apes are still a long way from matching CryptoPunks in terms of trading volume. CryptoPunks trade on a dedicated marketplace set up by the project’s creators, Larva Labs. With a four-year head start, CryptoPunk trades currently total over 770,000 ETH, or $2.92 billion at today’s prices. However, this is mostly due to the lower price of ETH in the early days of CryptoPunk trading.

The recent boom in Metaverse projects has also contributed to OpenSea’s explosive revenues. Decentraland, an online Metaverse project where players can own virtual land NFTs, is now the second most traded collection on the platform, coming in at 246,100 ETH or $933 million.

However, OpenSea’s success this year has not been without controversy. In September, the platform’s Head of Product Nate Chastain was exposed by the crypto community for insider trading and subsequently resigned. Chastain was caught buying NFTs from collections that were set to be promoted on the front page of the site, only to dump them on the market after the fact, netting substantial profits.

OpenSea also faced criticism again at the start of December, when the company’s new CFO, Brian Roberts, alluded to taking it public through an Initial Public Offering. Several prominent voices in the NFT community expressed disappointment in the move, claiming OpenSea was abandoning its users.

These controversies surrounding OpenSea, coupled with the high 2.5% commission on trades, have spurred efforts to launch a more decentralized, community-driven competitor to the leading NFT marketplace. So far, none have emerged as a real threat to OpenSea’s hegemony, but discontent among leading figures in the NFT community remains high.

While OpenSea has shocked onlookers with its parabolic growth in 2021, next year could be even bigger. Trading volumes on OpenSea only started to take off partway through the year, with the company generating over 94% of its revenue between August and December. If OpenSea can continue generating similar daily revenues and trading volumes next year, 2022 could be another blow-out year.

Disclosure: At the time of writing this feature, the author owned ETH and several other cryptocurrencies.

Disclaimer

Read More

Read Less

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: cryptobriefing.com