DeFi Project Spotlight: Bridge Mutual, the Insurance Protocol Built for Web3

Bridge Mutual is a decentralized, discretionary risk coverage platform for crypto assets and protocols.

Содержание статьи:

Shutterstock cover by F. ENOT

Key Takeaways

Bridge Mutual is a decentralized coverage platform that lets users purchase or underwrite insurance for crypto assets, decentralized protocols, and various centralized services. Users can protect their crypto portfolios from hacks, bugs, exploits, and rug pulls, or earn high yields on stablecoins as insurance underwriters.

Bridge Mutual Explained

Crypto, and especially decentralized finance, has seen staggering growth over the last two years. The global crypto market capitalization has grown from roughly $200 billion at the beginning of January 2020 to around $2.25 trillion nearing the end of this year. The total value locked in DeFi protocols, meanwhile, has soared from roughly $500 million to over $244 billion over the same period.

Unfortunately, this parabolic growth has been accompanied by a huge increase in hacks, exploits, and other security-related issues, resulting in significant losses of users’ funds. According to data from blockchain intelligence firm Elliptic, over $10.5 billion in value was lost due to theft and fraud in the sector in 2021 alone. Around $2 billion of that was stolen directly from decentralized applications.

The high number of attacks has increased the demand for risk-mitigating solutions. Projects typically seek to reduce the risks from bugs, hacks, or exploits by offering lucrative bug bounty programs and hiring third-party smart contract auditors. For investors, however, these procedures almost never guarantee complete safety, as the industry has already seen multiple seasoned and fully audited protocols experience costly security breaches.

One of the most reliable solutions for crypto investors has been purchasing smart contract coverage policies for crypto assets. One of the few crypto protocols that offers such insurance-like products is Bridge Mutual—a decentralized and permissionless discretionary risk coverage platform that lets investors buy or underwrite insurance policies for crypto assets, decentralized protocols, and various centralized services.

Bridge Mutual’s chief executive officer Mike Miglio and chief of operations Lukas Napiorkowski sat down with Crypto Briefing to discuss how the protocol works, and Napiorkowski revealed that the project took inspiration from another decentralized crypto asset cover provider, Nexus Mutual. However, Bridge Mutual takes a different approach in that it is permissionless. Napiorkowski explained:

“While Nexus Mutual admittedly inspired us, we’re going a different route. Namely, we’re a permissionless, privacy-focused platform with no KYC requirements. As the controlling entity, we’re also gradually relinquishing control of the protocol to the Bridge Mutual DAO, intending to eventually leave it entirely in the hands of the users.”

Discussing how the platform and the development team behind it currently operate, Napiorkowski said that Bridge Mutual is not a coverage company, but rather a decentralized entity building a platform that joins the dots between coverage providers and the users who need cover. “It’s an insurance hivemind of sorts,” he said, adding that the protocol mostly functions autonomously.

Bridge Mutual launched its minimum viable product in July, amassing more than $30 million in total value locked within days of the launch despite releasing only a few features. The initial version of the protocol only let users underwrite and purchase insurance policies for a select number of pre-approved DeFi protocols. While the MVP serves its purpose and works as designed, Miglio says it is a shadow of the fully-fledged Version 2 the team released earlier this month.

Bridge Mutual Version 2: The Great Reinforcement

Although it’s still only available for beta testing, Bridge Mutual Version 2 is an improved version of the protocol with several new user-facing features and greater capital efficiency.

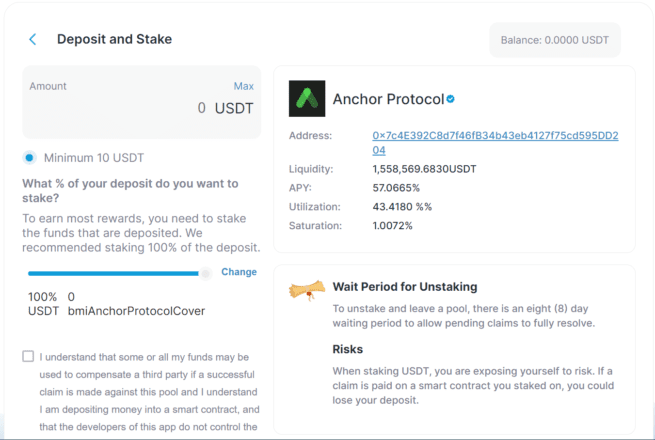

Bridge Mutual works by connecting coverage providers and policy purchasers. Coverage providers underwrite insurance policies by depositing collateral in USDT to specific coverage pools. In exchange for providing liquidity, insurance underwriters earn revenue from token rewards and the premiums paid by the insurance purchasers in the particular coverage pools. The rewards are paid in BMI, Bridge Mutual’s native token. The capital provided by the underwriters is used to cover policy holders when they make insurance claims against the protocol. On the other hand, users seeking to purchase coverage for their assets need to pay the required premium of the specific coverage pool. In exchange, they receive receipt tokens that represent their insurance policy.

Perhaps the most notable of the new features in Version 2 is the so-called “Leveraged Portfolios,” representing high-yield and high-risk profile pools that let users take out insurance policies across multiple assets or protocols at once. Under the hood, when someone makes a deposit through the Leveraged Portfolios feature, the capital gets deployed multiple times over in a single pool across numerous separate pools.

This novel insurance primitive significantly improves Bridge Mutual’s capital efficiency. This cuts the cost of its insurance policies and gives significantly higher yields to the underwriters that provide liquidity to the pools.

As Bridge Mutual is a decentralized and permissionless protocol, it lets anyone provide insurance coverage and earn a relatively high yield on stablecoin deposits. For example, underwriting insurance for Anchor Protocol, a lending platform on Terra that offers 19.5% interest on UST deposits, currently yields roughly 57% APY. Anchor holds over $10 billion in total value locked and has never been exploited, which could make underwriting insurance an attractive proposition for some users.

Source: Bridge Mutual

Source: Bridge MutualThose who don’t feel safe leaving their assets on Anchor without protection can leverage the Bridge Mutual platform to buy insurance on their deposits. Currently, the cost for such a policy is around 5%, which would leave investors with around 14.5% of yield on their insured investments given Anchor’s 19.5% fixed rate.

The pricing each policy on the platform is determined solely by supply and demand. Insurance policies become more expensive when the demand for coverage, or the “utilization ratio,” is high and the supply of coverage is scarce. Conversely, when a coverage pool has a large amount of unused liquidity, the cost for purchasing an insurance policy is lower.

While buying and providing coverage seems like a simple process from the users’ point of view, the protocol uses a number of complex innovations behind the scenes to ensure capital efficiency and retain competitive advantage within the decentralized insurance niche. For example, Bridge Mutual Version 2 has introduced two internal pools: the Reinsurance Pool and the Capital Pool.

The Reinsurance Pool uses protocol-owned assets to boost the supply of inexpensive insurance on selected coverage pools, thus improving operational and capital efficiency across the board. It is funded through 20% of all premiums paid by policy holders and the revenue generated from the Capital Pool.

The Capital Pool represents Bridge Mutual’s DAO-controlled investment arm. It is an externally oriented liquidity pool that utilizes idle, protocol-owned assets to earn yield across select DeFi platforms and generate revenue for the protocol and BMI holders. The Capital Pool works to aggregate the idle USDT from the coverage pools, put it to work on low-risk DeFi platforms, and let the DAO decide on how the generated revenue is spent.

Insurance Designed for Web3

Bridge Mutual’s focus on Web3 design principles has given it a moat effect against other similar protocols. It is decentralized, permissionless, DAO-controlled, and functions autonomously. “We’re big on decentralization and Web3,” says Napiorkowski. “We believe Bridge Mutual should be accessible and easy for everyone to use—wherever you are in the world, connect your wallet and get your coverage. This is the power of accessible crypto.”

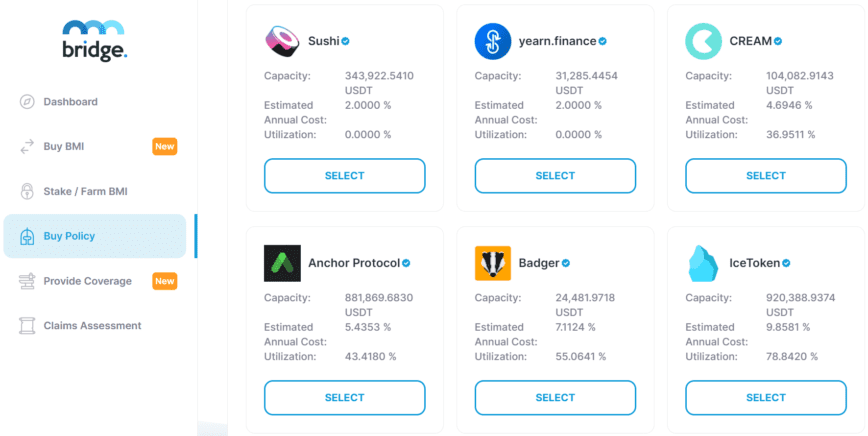

Bridge Mutual will soon let any individual or project create and provide liquidity for coverage pools for any smart contract, exchange, or listed service in crypto. Besides that, Version 2 also offers a shield mining feature that DeFi projects can use to create coverage pools for their protocols and use their native tokens to incentivize liquidity. Shield mining helps both individual DeFi projects and insurance underwriters: DeFi projects get to secure coverage liquidity for their protocols, while underwriters benefit from exposure to multi-token rewards.

Source: Bridge Mutual

Source: Bridge Mutual“Anyone can add their protocol or asset to our platform and make an insurance pool for it,” emphasizes Miglio, arguing that this gives the protocol a competitive advantage in the market. “In the long run, Bridge Mutual will have coverage for anything and everything, whereas other insurance protocols will only have the time to whitelist so-called “blue chip” projects.”

Bridge Mutual’s offered policies are currently limited to smart contract insurance. However, in the future, the protocol plans to expand its offerings to include stablecoin insurance to protect against de-pegging, and insurance for assets deposited on centralized service providers and exchanges such as Nexo, Blockfolio, Binance, and FTX. Miglio says he hopes that Bridge Mutual will also be able to provide more traditional types of coverage, such as health, vehicle, or malpractice insurance.

Final Thoughts

While hacks and exploits are a regular occurrence in the crypto space, demand for crypto insurance products has so far remained relatively low. However, this is unlikely to remain the case for too long. As the industry matures and more sophisticated investors with a more balanced appetite for risk enter the market, the demand for crypto insurance products should increase.

The total addressable market for such products is huge and goes beyond the size of the cryptocurrency market itself. As Bridge Mutual is one of the only privacy-focused and truly permissionless insurance protocols on the market, it has the potential to become a household name in crypto insurance. Its newly integrated Leveraged Portfolios product represents an entirely new and groundbreaking insurance primitive that could change the entire outlook of the crypto insurance market. By offering high, fixed-rate yields on stablecoin deposits, it could attract a new wave of investors on the risk-taking side of insurance and potentially lower the policy costs and increase the capital efficiency across the entire sector.

Disclosure: At the time of writing, the author of this feature owned ETH and several other cryptocurrencies.

Disclaimer

Read More

Read Less

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: cryptobriefing.com