Why is Bitcoin price down today?

Bitcoin price is down today after reaching a 2023 high above $23,300. Was the rally a bull trap and what will it take for BTC to regain its bullish momentum?

Own this piece of history

The bullish momentum that propelled Bitcoin (BTC) price to a 2023 high at $23,048 appears to have waned on Jan. 25 as the price dropped to a intraday low at $22,300. The pause in bullish momentum appears connected to lowered earnings expectations from big tech companies and the Federal Reserve’s Federal Open Market Committee (FOMC).

The contraction in Bitcoin price follows a market-wide decline, and analysts fear that the crypto market could face considerable danger from the FOMC decision.

Let’s take a closer look at the factors impacting Bitcoin price today.

Stocks correct on the expecation of poor earnings

Содержание статьи:

Stocks and Bitcoin price tumbled after recently released corporate earnings reports showed top companies like Microsoft (MSFT) revising down revenue projections as interest rates rise. As reported by Cointelegraph, Bitcoin price remains closely correlated to equities and stock market investors have previously expressed strong concerns about a potential upcoming recession in the U.S. economy.

Bitcoin correlation. Source: Coin Metrics

While some analysts believe Bitcoin’s current price represents a generational buying opportunity at current levels, others believe BTC’s close correlation to the U.S. dollar index (DXY) and equities is reflected by the price weakness at the $22,500 level.

Bitcoin price is reacting to the market’s consensus expectation of poor earnings impacting big technology companies like Microsoft, Alphabet, Salesforce and Tesla. On Jan. 25, Microsoft slid as much as 4% with the others losing as much as 3%.

In addition to steady layoffs in big tech, inflation seems to be drastically hindering company earnings, which may affect the Fed’s FOMC decision. According to John Butters, a senior earnings analyst with FactSet:

“Higher costs are likely having a negative impact on net profit margins. Producer prices increased by 6.2% in December. Again, although the number has been falling over the past several months, the percentage has exceeded 6.0% (year-over-year) for 21 straight months. During the previous earnings season, 402 S&P 500 companies cited “inflation” on earnings calls for the third quarter, which was the third-highest number in more than 10 years. Companies may be having more difficulty raising prices to offset higher costs, as the S&P 500 is reporting its lowest revenue growth for Q4 2022 (3.7%) since Q4 2020 (3.2%).”

S&P 500 profit margins. Source: FactSet

Technology companies are not the only companies struggling with tight profit margins. While Bitcoin miners recently showed signs of recovery, the headwinds from earnings season could put pressure on razor thin BTC profit margins.

Rising interest rates in the U.S. and abroad weigh on Bitcoin price

The Consumer Price Index (CPI) report on Jan. 12, showed inflation decreasing 0.1%, but Federal Reserve Chairman Powell still wants to reach 2% overall inflation. Inflation has been a determining factor in raising interest rates. In order to combat inflation, Chairman Powell may not be able to pivot the aggressive rate hike strategy.

The Consumer Price Index report – the most widely followed barometer of inflationary pressure in the United States – is leading the market to speculate that a 0.5% interest rate hike is possible at the FOMC meeting on Feb. 1.

Rate increase probability. Source: CME Group

On the back of persistently sticky inflation, some analysts believe Bitcoin is in for a cold winter and the price could continue to see volatility leading into next week’s FOMC.

Bitcoin long futures liquidated as BTC price corrected

On Jan. 23 and Jan. 24, the Bitcoin futures market saw $230 million in liquidations on long positions. This put further pressure on BTC price. When BTC longs are liquidated without buy pressure from trading volume, Bitcoin price is negatively affected.

BTC liquidations. Source: Coinglass

As market makers and crypto-oriented firms struggle to maintain operations during the bear market, the fall-out is witnessed directly through reduced trading volumes. According to Arcane Research, while volumes have elevated to begin 2023, levels have yet to reach 2022 yearly highs.

Real BTC-USD Daily Volume. Source: Arcane Research

Related: $1.48B in Bitcoin options expire on Friday — Will BTC hold $22K?

The recent uptick in Bitcoin trading volume could have been ignited by a short squeeze. Bendik Schei, head of research at Arcane Research presumed from data that:

“The prevailing high trading volumes indicate that the speculative appetite has grown. While a structural short squeeze ignited the strength, it’s promising to see that the momentum is supported by persistent high spot volume.”

If this is the case, that means there is not a large cushion of buy pressure for Bitcoin long liquidations leading to further downside.

Is there a chance for Bitcoin price to reverse course?

The short-term uncertainties in the crypto market do not appear to have changed institutional investors’ long-term outlook. According to BNY Mellon CEO Robin Vince, a poll commissioned by the bank found that 91% of institutional investors were interested in investing in tokenized assets in the following years.

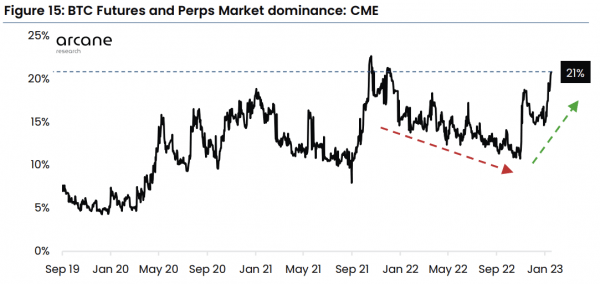

CME, a leading tool for institutional investors to gain Bitcoin exposure, has seen its dominance grow in January. Such growth shows institutional investors have been returning since November 2022.

CME market share. Source: Arcane Research

In the short term, worries are high with Bitcoin price being directly impacted by macroeconomic events, and it is also likely that next week’s FOMC is also having some effect on BTC price.

In the long term market participants still expect the price of Bitcoin to go up, especially as more banks and financial institutions are seemingly turning to digital cash for settlement purposes even amidst the chaos.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Source: cointelegraph.com